Do You Have High Influence On Your Company’s Product Cost?

By Craig Theisen

Product costs, also known as cost of goods sold (COGS) are direct material, direct labor, and manufacturing overhead. COGS are typically the highest category of a manufacturing company’s cost, and they have a huge impact on the company’s competitiveness.

COGS are inherently added to products as they are designed and made ready for production. They are inherent because they have been pre-established by the design. The COGS are driven into the product by employees responsible for four key designs that drive COGS:

1. The product’s design

2. The manufacturing process design

3. The manufacturing equipment and tooling design

4. The value stream / supply chain design

Each of these designs impact product costs (COGS).

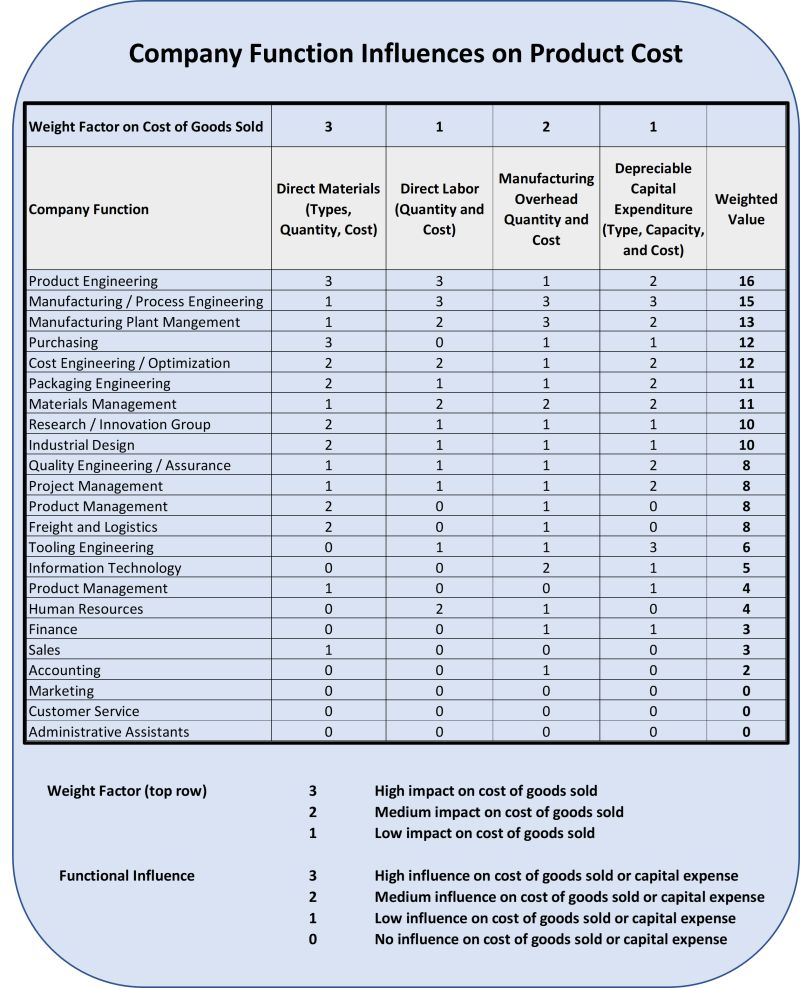

The illustration depicts the company functions that influence product cost, in descending order, based on a weighted value of their influence on direct materials, direct labor, manufacturing overhead, and depreciable manufacturing capital. I’ve included a column for depreciable capital, even though it is often included within manufacturing overhead, because it has a large impact on a company’s cash flow and return on assets.

A weighting factor of 1 to 3 is assigned to the four columns based on how much impact each category has on the overall product cost. Direct material has the highest factor of 3. A score of 1 to 3 is also assigned to the company functions’ influence on a column category.

For example, the company function with most influence on product cost is product engineering. They lead the product design which directly defines direct materials and indirectly, but significantly defines direct labor, manufacturing overhead and capital.

The next company function with high influence is manufacturing / process engineering. They develop the manufacturing process including the usage of direct labor, manufacturing overhead, and manufacturing capital equipment.

The main point of the table is to show how much influence the different functions within a company have on the company’s product costs. Then provide a way for the top influencing functions to excel at optimizing product costs through knowledge and collaboration with other high-influence functions.